We frequently hear about how interest rates are rising in recent months. If you are looking into purchasing a home, this may make you feel hesitant about taking out a loan due to the knowledge you know you would have to pay more in the long run due to higher interest rates.

However, as we look closer at the nature of interest rates, as well as the larger timeline of interest rates, you might change your mind.

How Do Interest Rates Play a Role in Home Buying?

Interest rates affect the economy because they determine how much consumers and businesses spend by influencing costs of borrowing and spending. Lowered interest rates encourage consumers and businesses to borrow more and spend more. However, Raising rates generally discourages consumers and businesses from borrowing more and spending more.

In this case, the borrowing and spending in question is a large sum of money going toward purchasing a home.

Why Are Interest Rates Rising?

The Federal Reserve sets interest rates to promote full employment, price stability, and low and stable inflation.

Within this year, Inflation has been rising more sharply than initially expected by analysts. Consumer prices are rising sharply. Food and energy costs are included in this report. Prices are up 5.2% excluding volatile food and energy costs. Inflation has been driven by high consumer demand for goods and services, which has outpaced the ability of businesses to produce them. People pull out a gallon of milk when shopping at a grocery store. High inflation has caused the price of goods and services to rise.

In response to this circumstance, Federal Reserve Chair Jerome Powell says he will continue to raise interest rates until inflation slows. The Federal Reserve is not considering raising interest rates by more than half a percentage point each time.

Should We be Concerned?

By this logic, rising interest rates should be a cause for concern for both buyers and sellers.

However, there is one missing element: Context.

A Timeline of Interest Rates.

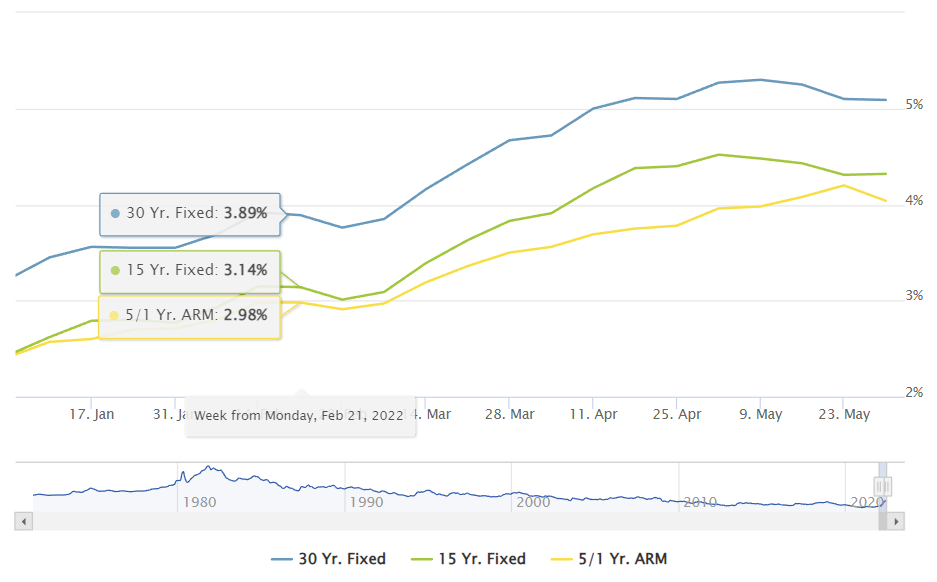

If we look at a recent time window of interest rates, it can look rather startling.

From the start of this year, it would appear that interest rates have nearly doubled.

From the start of this year, it would appear that interest rates have nearly doubled.

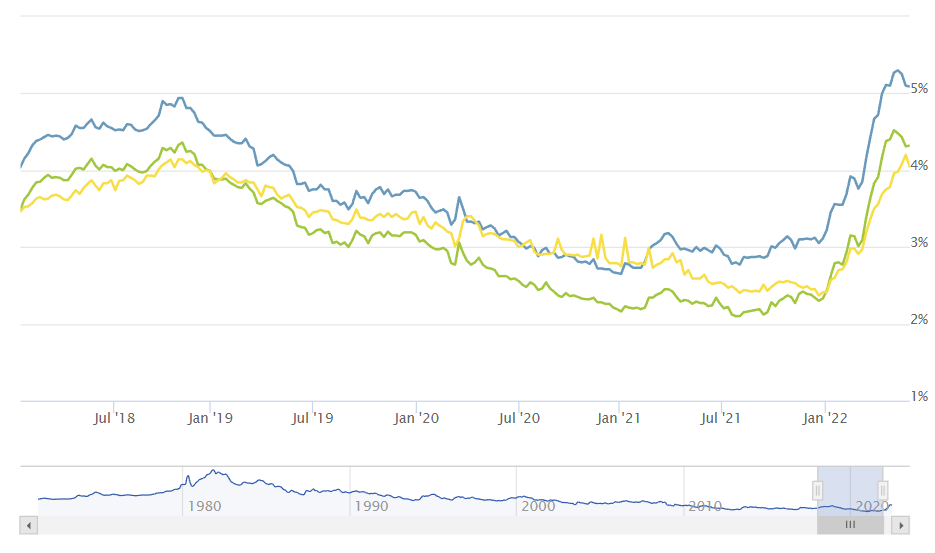

However, if we expand our timeline further, we’ll have a better perspective on this increase.

Within this four year window, we can see that interest rates are only slightly higher than it was four years ago.

Within this four year window, we can see that interest rates are only slightly higher than it was four years ago.

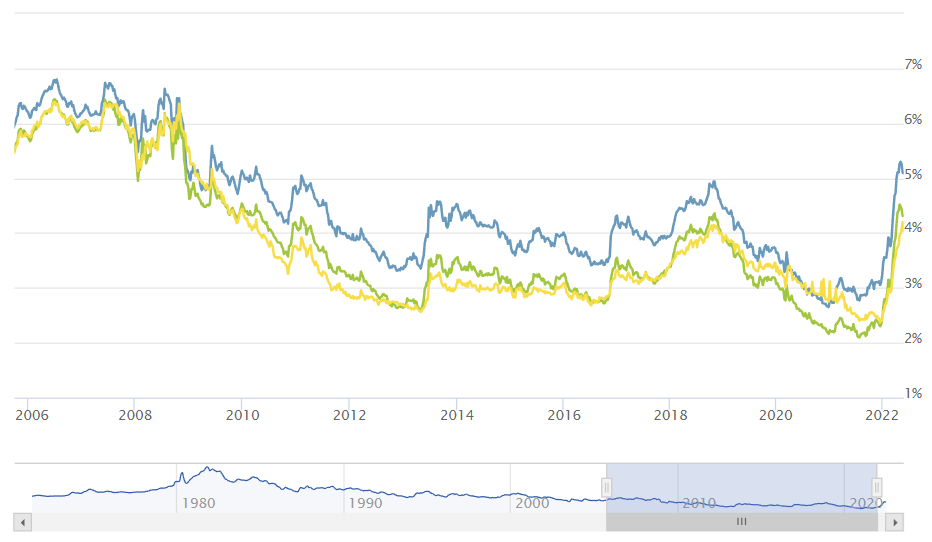

As we further expand this time window, we see even better context.

And finally, from a larger, perhaps more historical standpoint.

And finally, from a larger, perhaps more historical standpoint.

As we can see, we find our interest rates just coming up from the lowest rates in known history.

While we’ve seen a relatively sharp increase in interest rates, this current period is still one of the more ideal times in decades.

Where Do Interest Rates Go From Here?

While we have seen rates come down a little since the spike in April, interest rates may be subject to change with other current economic factors.

However, my job as a realtor is to keep a close eye on interest rates and other factors that can affect your home-buying experience. If you would like to speak with me personally on this matter, contact me here or call me at (208) 401-4066.